The Difference Between Power of Attorney (POA) and Guardianship

I. Introduction

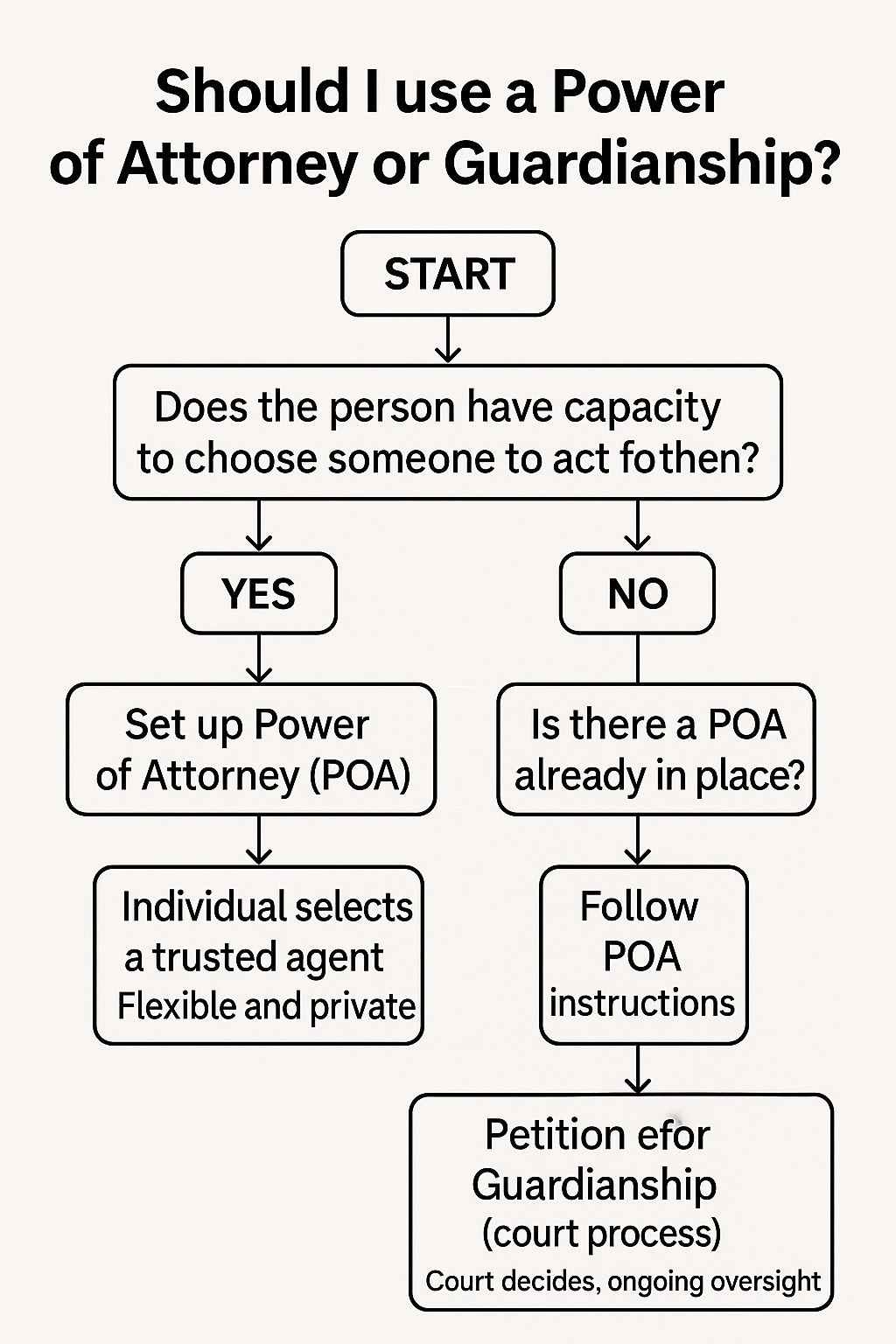

When someone can’t manage their affairs, loved ones may face the daunting choice between POA and guardianship. This decision is often made during times of emotional distress and can have a profound impact on families and individuals. This blog will discuss the differences between the two and will have a decision chart to help you decide what is best in your situation.

II. What Is Power of Attorney (POA)?

Definition: Legal document appointing someone (the agent) to act on behalf of another (the principal).

Types: Financial vs. Medical (or Healthcare) POA; Durable vs. Non-Durable POA.

Key features:

Chosen by the individual while they have capacity.

Flexible—can be limited or broad.

Usually less costly, private, and quicker than guardianship.

III. What Is Guardianship?

Definition: A legal relationship where a court appoints a guardian to make some or all decisions for a person (the “ward”) who is incapacitated and can no longer make informed decisions.

Types: Guardian of the person (personal/medical decisions) vs. guardian of the estate (financial affairs).

Key features:

Requires court proceedings, medical evaluations, and often ongoing court oversight.

Used as a last resort when no valid POA exists or is insufficient, or when safety and best interests demand intervention.

More expensive, public, and restrictive (often removes many of the ward’s rights).

IV. Major Differences Between POA and Guardianship

Who decides:

POA: The individual chooses their agent in advance.

Guardianship: The court appoints a guardian if the individual can no longer make this decision.

Timing:

POA must be set up while the person still has mental capacity.

Guardianship can be imposed once capacity is lost.

Revocability:

The principal can revoke the POA if they are competent.

Guardianship can only be changed or removed by the court.

Cost & privacy:

POA is generally less expensive and private.

Guardianship is a public record and incurs court/legal fees.

Scope:

POA can be tailored or limited.

Guardianship is comprehensive but with stricter court supervision.

V. Pros and Cons

POA:

Pros: Empowers individual choice, flexible, cost-effective, private.

Cons: Requires foresight; sometimes not recognized by all institutions; can be revoked or altered by the principal if capacity fluctuates.

Guardianship:

Pros: Protective with court oversight, available when no POA exists or there is risk of abuse.

Cons: Time-consuming, expensive, removing individual rights, and is emotionally difficult for families.

VI. When Is Each Necessary?

POA: Best done in advance during estate planning, or if the person still has capacity.

Guardianship: Necessary if the person is already incapacitated and no POA is in place, or if abuse, neglect, or exploitation is suspected.

VII. Empathic Guidance for Families

The importance of proactive planning (encourage discussing wishes before a crisis arises).

The emotional and practical toll of guardianship.

How to seek support—from elderly law attorneys, advocacy groups, and family meetings.

Encouragement: You’re not alone, and seeking the best interest of your loved one is an act of compassion.

IX. Conclusion

Reassure: Every situation is unique; choosing the right tool is about balancing protection, autonomy, and compassion.

Call to action: Start these conversations with loved ones and professionals now, while planning is possible.

Understanding POA and Guardianship in Real Life

Case Example 1: Using Power of Attorney (POA)

Maria’s Story:

Maria, a retired teacher, began noticing memory issues in her late 60s. Concerned about her future, she met with an elder law attorney and appointed her daughter, Evelyn, as her Durable Power of Attorney (DPOA) for both financial and healthcare matters. When Maria's condition worsened a few years later, Evelyn was able to manage her mother’s investments, pay bills, and assist with medical decisions—all according to Maria's expressed wishes. Because the POA was in place while Maria was still capable of making decisions, the family avoided court proceedings and upheld Maria's autonomy for as long as possible.

Key takeaway: POA empowers individuals to choose their representative before incapacity and can help avoid lengthy court involvement.

Case Example 2: When Guardianship Becomes Necessary

James’s Story:

James, a widowed veteran with no close relatives nearby, suffered a major stroke and lost the ability to communicate or manage his care. Because he had never created a Power of Attorney, his niece, Linda, had to petition the court for guardianship to oversee his medical treatment and living arrangements. The process involved legal fees, court dates, and ongoing court-supervised reporting. While stressful, guardianship ensured James’s safety when no POA existed.

Key takeaway: Guardianship is crucial when a person cannot make or communicate decisions and has not set up a POA, but it is more complex and court-involved.

Case Example 3: We’re Not Ready for That” – Until It’s Too Late

Sarah’s Story

For years, Sarah gently urged her parents to set up Power of Attorney documents.

“Just in case,” she’d say. “It’s about having a plan. “But every time she brought it up, they brushed it off. “Oh, that’s too expensive,” her dad would say.

“We’re not ready for that,” her mom would add with a wave of the hand.

The irony was painful; one of them was already showing signs of early dementia. The other had taken on the quiet, exhausting role of caregiver. Still, the conversation always ended the same way: in avoidance.

Then, as often happens, life took a sudden turn. The healthy parent—the caregiver—became gravely ill. In a matter of weeks, the person everyone relied on could no longer care for themselves, let alone their spouse. The family stepped in, but the situation quickly became overwhelming. Decisions had to be made about medical care, finances, and legal matters, but no one had the legal authority to act.

That’s when reality finally sank in.

A relative sat down with Sarah’s parents and explained the truth:

Without a Power of Attorney, the only option left would be guardianship, a long, expensive, and very public legal process controlled by the courts. It would mean endless paperwork, reporting requirements, and fees. It would mean giving up more control than they ever imagined.

That conversation changed everything.

In one of their final acts together, the ailing parent agreed to get a Durable Power of Attorney for the surviving spouse, granting Sarah the ability to step in when needed. Attorneys were called and decided that the spouse with dementia was still cognitive enough to understand what they were signing. Just weeks later, that caregiving parent passed away.

Because of the POA, Sarah was able to take over and manage her surviving parent’s care immediately. There was no court. No delays. No red tape. Just the ability to help—when it mattered most

Recommended Supporting Links and Sources:

ElderLawAnswers: What’s the Difference Between Guardianship and Power of Attorney?

Brown & Barron: The Difference Between Power Of Attorney And A Guardianship

Providence Life Services: Power of Attorney vs. Guardianship

Meltzer & Bell: Guardianship vs. Power of Attorney: Key Differences

Decision Tree Graphic: POA vs. Guardianship